- You have no items in your shopping cart

- Continue Shopping

Become an Insurance Agent

Original price was: ₹100.00.₹10.00Current price is: ₹10.00.

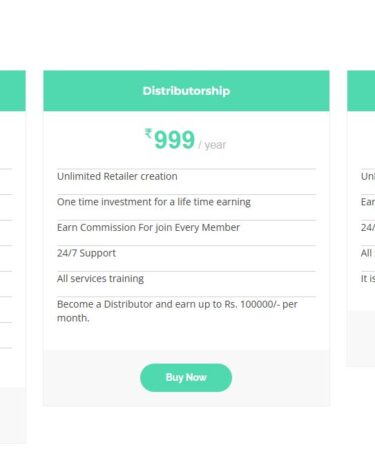

Are you eager to start a successful insurance agency? Do you want to become a certified vehicle insurance agent? Our comprehensive digital package, “Become an Insurance Agent” provides you with the essential tools and knowledge to excel in the industry.

Kickstart a rewarding career in the insurance industry with our exclusive “Become an Insurance Agent” program! This comprehensive package is designed for aspiring professionals looking to specialize in vehicle insurance. Whether you’re interested in cars, bikes, or commercial vehicles, our program provides you with everything you need to establish and grow a successful insurance agency.

What You’ll Learn:

- Foundations of Insurance: Gain in-depth knowledge of vehicle insurance types, coverage plans, and policies.

- Sales & Marketing Techniques: Master the skills required to attract clients, close deals, and build lasting relationships.

- Legal & Compliance Essentials: Understand the legal landscape of the insurance industry and stay compliant with regulatory standards.

- Customer Management: Learn how to handle claims, renewals, and customer service to retain clients and increase referrals.

Why Become an Insurance Agent?

- High Demand & Growth: With the rising number of vehicles on the road, the demand for reliable vehicle insurance agents is soaring.

- Flexible & Lucrative: Enjoy flexible working hours and high earning potential as an independent agent or under a recognized insurance brand.

- Comprehensive Support: Get full training, marketing support, and industry insights to thrive in this dynamic field.

Get started today and become a trusted vehicle insurance advisor in your community!

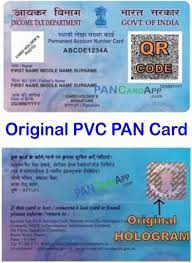

Requirements:

1. Basic computer skills

2. Internet connection

3. Desire to succeed in insurance sales

1. Life Insurance

- Term Life Insurance: Coverage for a specific term (e.g., 10, 20, 30 years).

- Whole Life Insurance: Permanent life insurance with a cash value component.

- Universal Life Insurance: Flexible policy with adjustable premiums and death benefits.

- Variable Life Insurance: Permanent policy allowing cash value investments.

- Final Expense Insurance: Covers funeral or end-of-life expenses.

- Mortgage Life Insurance: Pays off remaining mortgage in case of policyholder’s death.

- Group Life Insurance: Offered by employers to their employees.

2. Health Insurance

- Individual Health Insurance: Private insurance covering individual health needs.

- Family Health Insurance: Covers entire family under one policy.

- Group Health Insurance: Offered by employers for employees.

- Critical Illness Insurance: Lump sum payment on diagnosis of critical illnesses like cancer, heart attack.

- Accident Insurance: Covers injury-related expenses.

- Dental Insurance: Covers dental checkups, treatments, and surgeries.

- Vision Insurance: Provides benefits for eye exams, glasses, and contacts.

- Disability Insurance: Income replacement in case of disability.

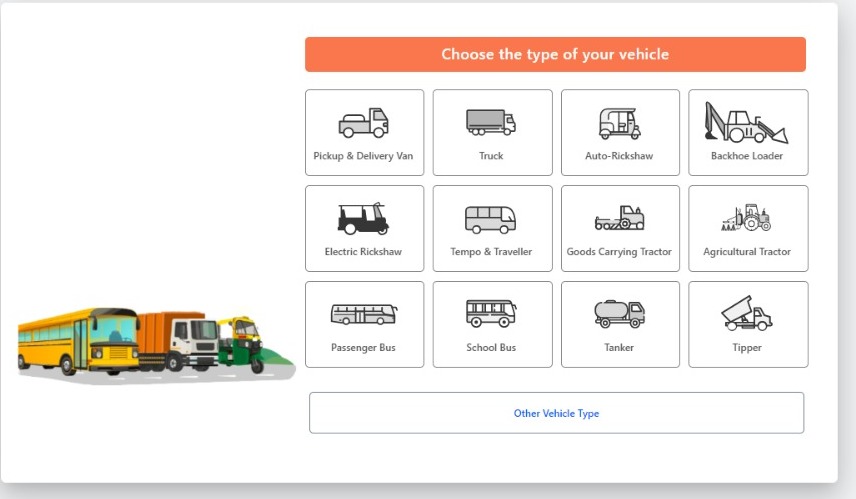

3. Vehicle Insurance

- Auto Insurance: Covers cars and other four-wheelers.

- Liability Insurance: Covers damage to others’ property and injuries.

- Collision Insurance: Covers damage to your own vehicle.

- Comprehensive Insurance: Covers non-collision damages (e.g., theft, fire).

- Motorcycle Insurance: Coverage for motorcycles.

- Commercial Vehicle Insurance: For vehicles used for business purposes.

- Third-Party Liability Insurance: Mandatory insurance covering third-party injuries or damages.

- Two-Wheeler Insurance: Covers scooters, bikes, and other two-wheelers.

4. Property Insurance

- Homeowners Insurance: Protects home and belongings against damage or theft.

- Renters Insurance: Covers belongings for renters.

- Landlord Insurance: Protection for rental property owners.

- Flood Insurance: Specifically covers damage due to flooding.

- Earthquake Insurance: Covers damages from earthquakes.

- Fire Insurance: Protection against fire damage.

- Title Insurance: Protects against legal claims on property ownership.

5. Liability Insurance

- General Liability Insurance: Covers business liabilities for injuries and damages.

- Professional Liability Insurance (Errors and Omissions): For professionals like doctors, lawyers.

- Product Liability Insurance: For businesses to cover damages caused by their products.

- Directors and Officers (D&O) Insurance: Protects executives from personal losses.

- Cyber Liability Insurance: Covers cyber-attacks, data breaches, and IT-related risks.

6. Travel Insurance

- Trip Cancellation Insurance: Covers non-refundable trip costs if canceled.

- Medical Travel Insurance: Covers medical emergencies while traveling.

- Baggage Loss Insurance: Covers loss or damage to baggage.

- Flight Delay Insurance: Compensates for delays beyond certain hours.

- Evacuation Insurance: Covers costs for emergency evacuations.

7. Business Insurance

- Commercial Property Insurance: Covers buildings and assets owned by a business.

- Business Interruption Insurance: Covers income loss due to disruptions.

- Workers’ Compensation Insurance: Protects employees with workplace injury coverage.

- Equipment Breakdown Insurance: Covers repairs for business machinery.

- Key Person Insurance: Covers loss due to death of a crucial employee.

8. Pet Insurance

- Accident and Illness Coverage: Covers veterinary expenses for pets.

- Wellness Coverage: Covers routine exams and preventive care.

9. Other Specialized Insurance Types

- Marine Insurance: Coverage for ships, cargo, and sea transport risks.

- Aviation Insurance: Covers aircraft, liability, and passenger risks.

- Agricultural Insurance: Covers farming risks, crop insurance, livestock.

- Burial Insurance: Pre-paid insurance to cover funeral costs.

- Credit Insurance: Protects creditors from debtor defaults.

- Kidnap and Ransom Insurance: Protects against ransom demands.

Each type of insurance is designed to protect against specific risks, ensuring financial security in various situations.

Shipping Policy

Refund Policy

Cancellation / Return / Exchange Policy

General Inquiries

There are no inquiries yet.

Product Recently View

You have not recently viewed item.

Customer reviews

Reviews

There are no reviews yet.

Write a customer review